Two years ago during the holiday shopping season in December, then-sophomore David Tapia recalls walking into the Tokyo Japanese Lifestyle gift shop at the MainPlace Mall in Santa Ana.

“I wanted to buy a Pompompurin plush and a Tanjiro figure for my sister for Christmas,” Tapia says. “I was so excited to buy the gift because it was for my sister; we were doing Secret Santa for family.”

He had bought similar items the previous year for his other sister and thought he knew what the gifts would cost: the plush around $25 and the figure $30.

With only a $50 budget, Tapia remembers seeing the price tag for each item at the MainPlace store: $45 for the plush and $35 for the figure.

Since the combined cost along with sales tax would lead to around $35 over his budget, Tapia says he decided to purchase only the plush.

“I’ve always looked for one gift that means a lot that I would get for sure, and then smaller extra gifts to go with it, so I was kind of sad when I couldn’t get both,” the current senior says. “With the rising prices, I’ve been having to buy only the main gift.”

Though this experience happened in 2022, Tapia — including many other shoppers nationwide — has continued to feel high item costs the past two years. And although inflation has dramatically dipped from a high of 6.5% in December 2022 to 2.7% this November according to the U.S. Bureau of Labor Statistics, this economy has still deterred customers from spending more during this holiday season.

According to an October PricewaterhouseCoopers [PwC] article, 40% of consumers say they intend to spend the same amount this holiday season as the last and 29% plan to spend less. This is despite the rate of inflation decreasing from 3.1% to 2.7% over this year, according to the U.S. Bureau of Labor Statistics.

Additionally, although a combined 69% plan to spend the same or less as the previous year, holiday spending is projected to increase by 7%, according to the PwC article. This is because the 26% who plan to spend more are allocating $3,076 on average — more than four times the budget of those cutting back.

Sunny Hills students like sophomore Ysabel Giana Eneria find themselves in the 40% of consumers who plan on maintaining the same budget this winter. However, when considering inflation, she can’t buy as much as in previous years.

“I always get excited to holiday shop because I love to shop for other people, but I don’t think I’ll be buying as much as I usually do,” Eneria says. “I have noticed the changes in cost for certain things I usually buy, especially with makeup and stuff.”

Likewise, freshman Natalie Hong says she has no plans to increase her spending this year.

“I feel like clothes have increased in price a lot,” Hong says. “If you go to the mall a pair of jeans is over $50 and it used to be around $40.”

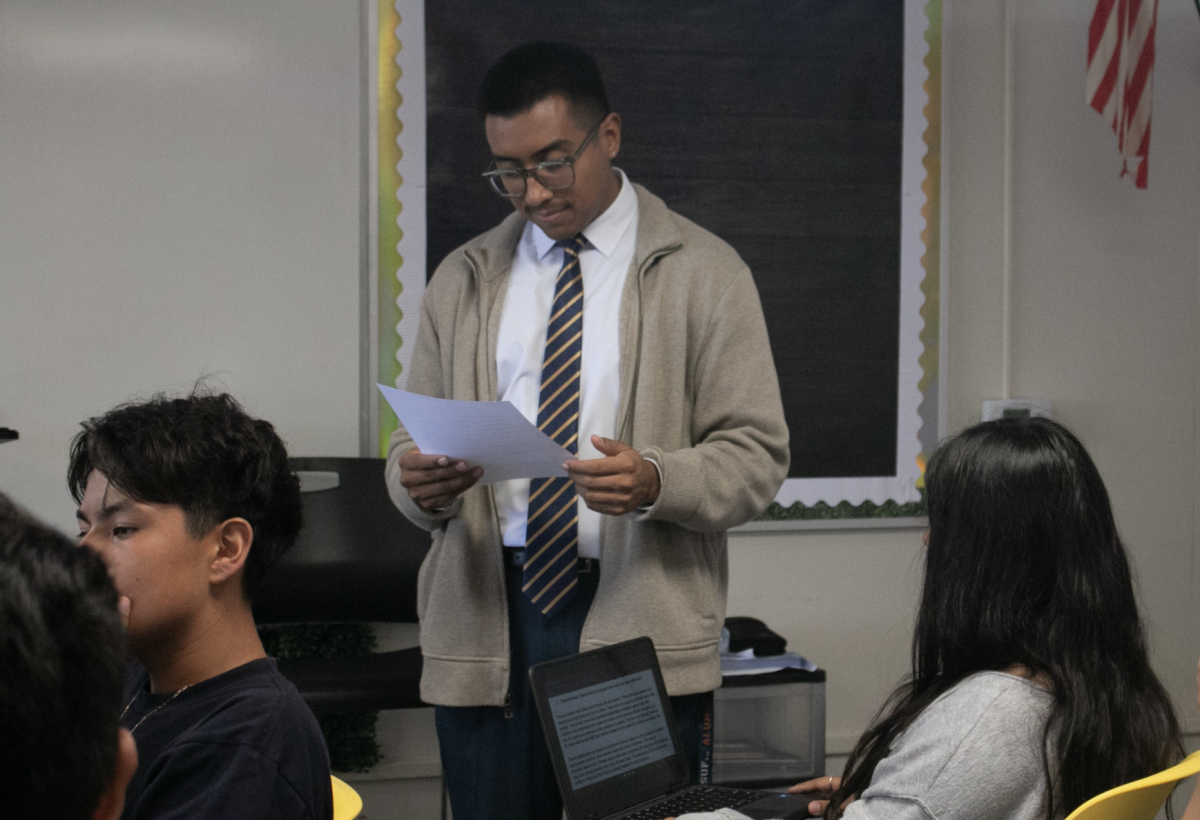

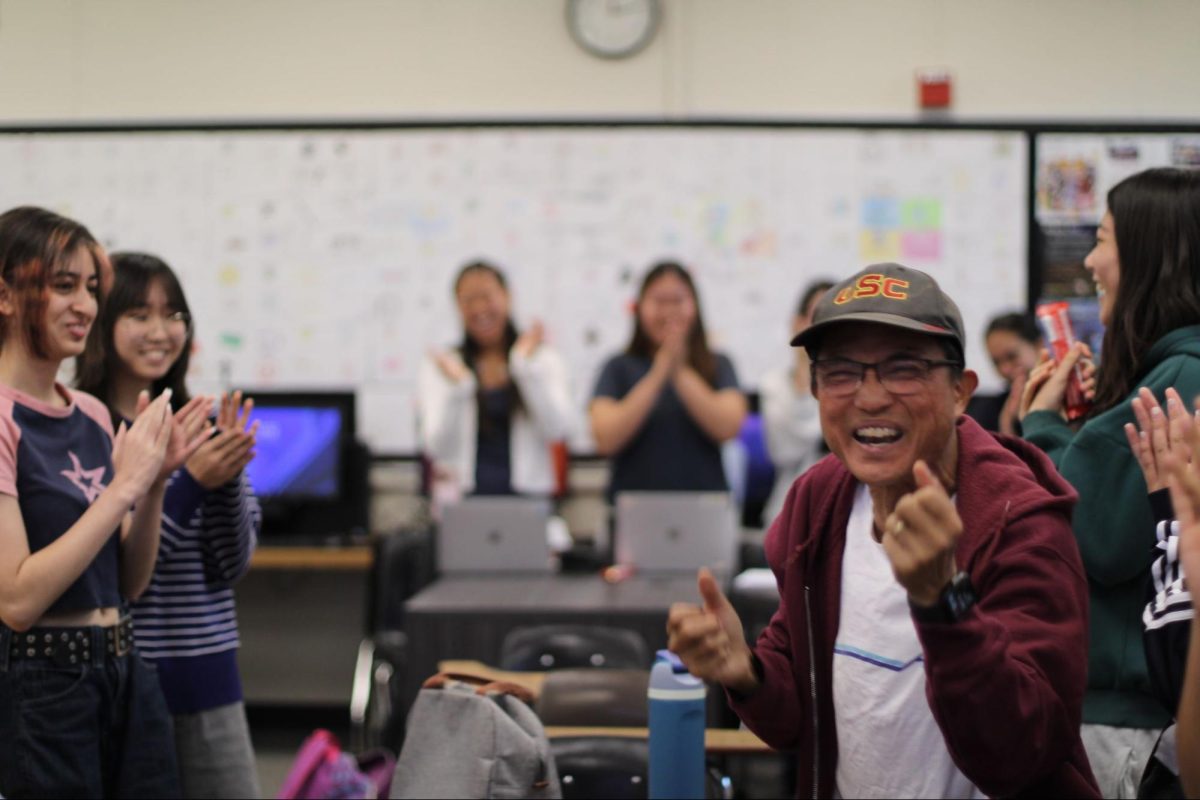

Inflation and how it affects the economy has been a common topic in social science instructor Robert Bradburn’s International Baccalaureate Economics HL2 class, which is comprised of seniors.

“The rate of growth is usually very close to the inflation rate, but it takes a while to catch up, and that’s why people get so nervous and unhappy [about prices],” Bradburn says.

As a result, many people feel they do not make enough money to match the high prices, still feeling the high rates of 2022 when inflation reached a peak of 9.1% in June, according to the U.S. Bureau of Labor Statistics.

Because of the harsh economic situation, Bradburn has concluded that people may also feel unhopeful for the future, resulting in many people choosing to spend less or the same amount.

“Holiday spending is a lot about people’s belief about the future; if they think their job will be stable next year — that they might even get a promotion and that times are good — then they’ll spend more on the holidays,” the teacher says.

And that’s what might have happened last month for Black Friday sales. According to a Saturday, Nov. 30, Reuters article, Black Friday spending rose 3.4% year-over-year. When adjusted for inflation, spending rose by 0.7%.

“Because many Americans believed that Mr. [Donald] Trump would help the economy more than Ms. [Kamala] Harris, I think it’s possible that [this] increased their confidence and spending for the moment,” Bradburn says.

Although spending has gone up during Black Friday sales, Bradburn stresses the importance of correcting mistaken assumptions about the economy that may cause some to spend less.

“There are some people who think that prices will go back down; they don’t realize that that almost never happens,” he says. “People remember what prices were a few years ago; they may not remember much from high school history, but they do remember the price of gasoline and eggs a few years back, and it will take them a long time to get used to the new prices.”

ARE LOCAL BUSINESSES STILL SUFFERING?

Despite higher prices, Amerige Heights Town Center Bath & Body Works key holder Amanda, who declined to share her last name, says she hasn’t noticed a decrease in sales.

Instead, she says higher prices have prompted buyers to be more savvy with their purchases.

“Mainly people just come on sale days instead of buying full price because of how expensive they are,” Amanda says. “We have been having more weekend sales now though compared to before [high inflation rates].”

Kenia, the Target service and engagement team lead for the store in Amerige Heights Town Center, says sales haven’t changed much since the drop caused by the COVID-19 pandemic in 2020.

“Once people began getting government assistance during the pandemic, they began buying more, but that was only for a short while,” says Kenia, who also declined to share her last name.

Although inflation rates were low in 2020, averaging 1.2% according to the U.S. Bureau of Labor Statistics, Kenia says Target still saw a drop in sales because of the lockdown. In the following years, sales did not increase much because although foot traffic increased, inflation began to rise.

“Now, more people decide not to purchase things at checkout once they see the pricing,” she says. “Before, this wouldn’t happen very often, but now it’s very common.”

Since the price increases, Kenia says she has noticed that Target has had more frequent sales, although the sales are not as large as they were before the pandemic.

“Before, [sales] would be up to 50% off, but now it’s usually around 30%,” she says. “In my opinion, less frequent but stronger sales would be better.”

ARE SECRET SANTAS AFFECTED BY THE INFLATION SCROOGE?

With prices higher, students like Hong, who would previously purchase individual gifts for friends, have moved toward activities like Secret Santa to maintain a lower budget.

“I’m buying less gifts this year because I’m choosing to do more group giving like Secret Santa,” she says. “I feel like it’s gotten way more expensive to buy everyone gifts.”

Eneria has also looked toward more group-based gifting with money being a concern.

“I have been doing more Secret Santas because I like that I can add a budget,” Eneria says. “The prices of gifts have led me to having a lower budget.”

WHAT ABOUT THIS CHRISTMAS FOR TAPIA?

Tapia, who plans to start purchasing items for his annual family Secret Santa in mid-December, says while he’s maintaining his budget of $50, he anticipates more careful spending.

“Everything is really expensive right now, and that $50 is just for my family — I still need to buy things for friends, so I really need to watch my budget,” he says.